Zapalování-Elektro | MOTOJELÍNEK.CZ - náhradní díly a příslušentsví JAWA, ČZ, JAWA-ČZ, Simson, Stadion, Babetta a další.

USB dvoj zásuvka s voltmetrem do auta lodě s krytkou, vodotěsná | 2Racing autodíly nejen pro rally, tuning, drift motorsport

Nabíječka Akyga AK-CH-13 USB-A + USB-C PD 5-12V / max. 3A 36W Quick Charge 3.0 | Baterie a akumulátory za nejlepší ceny

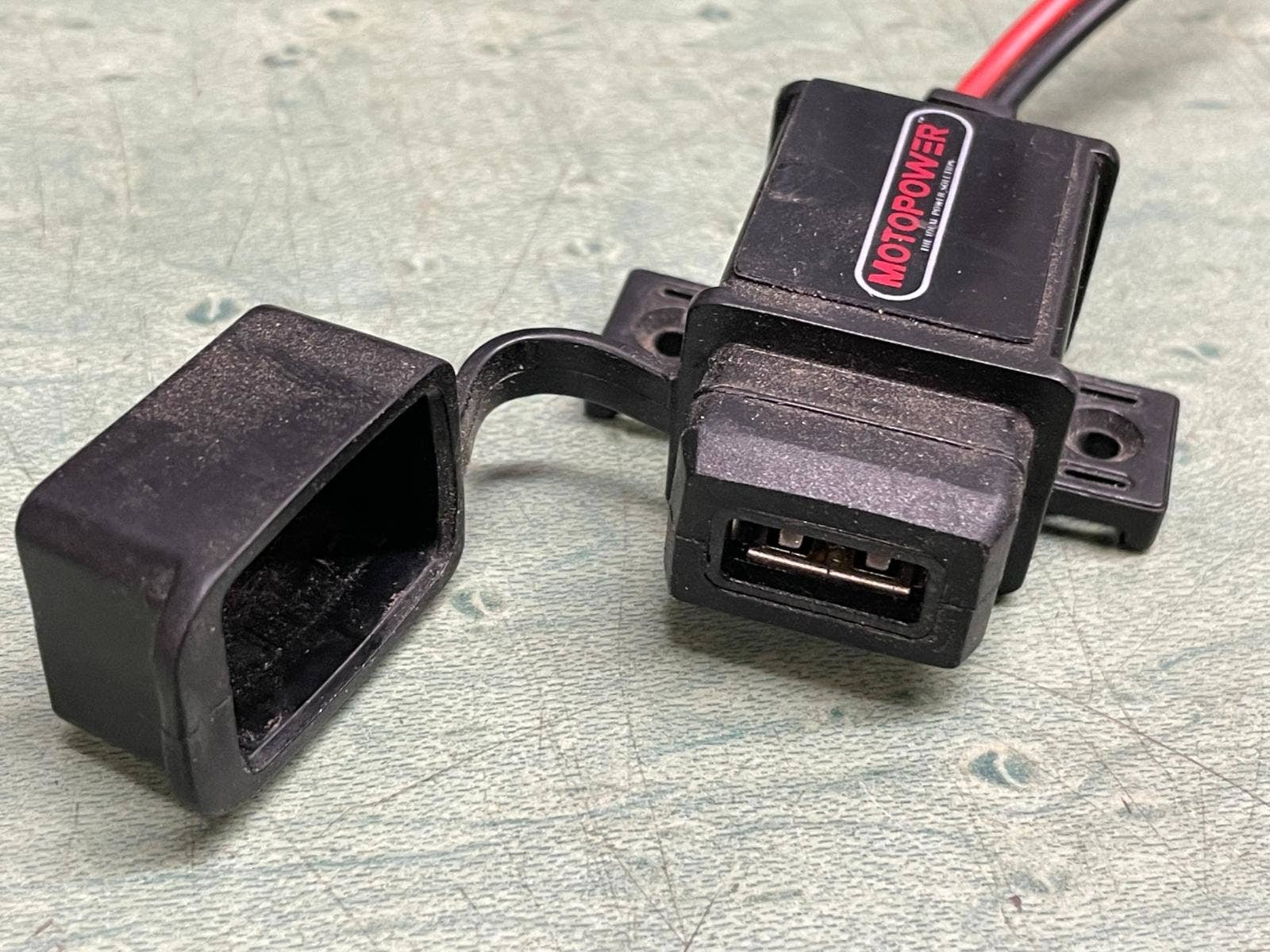

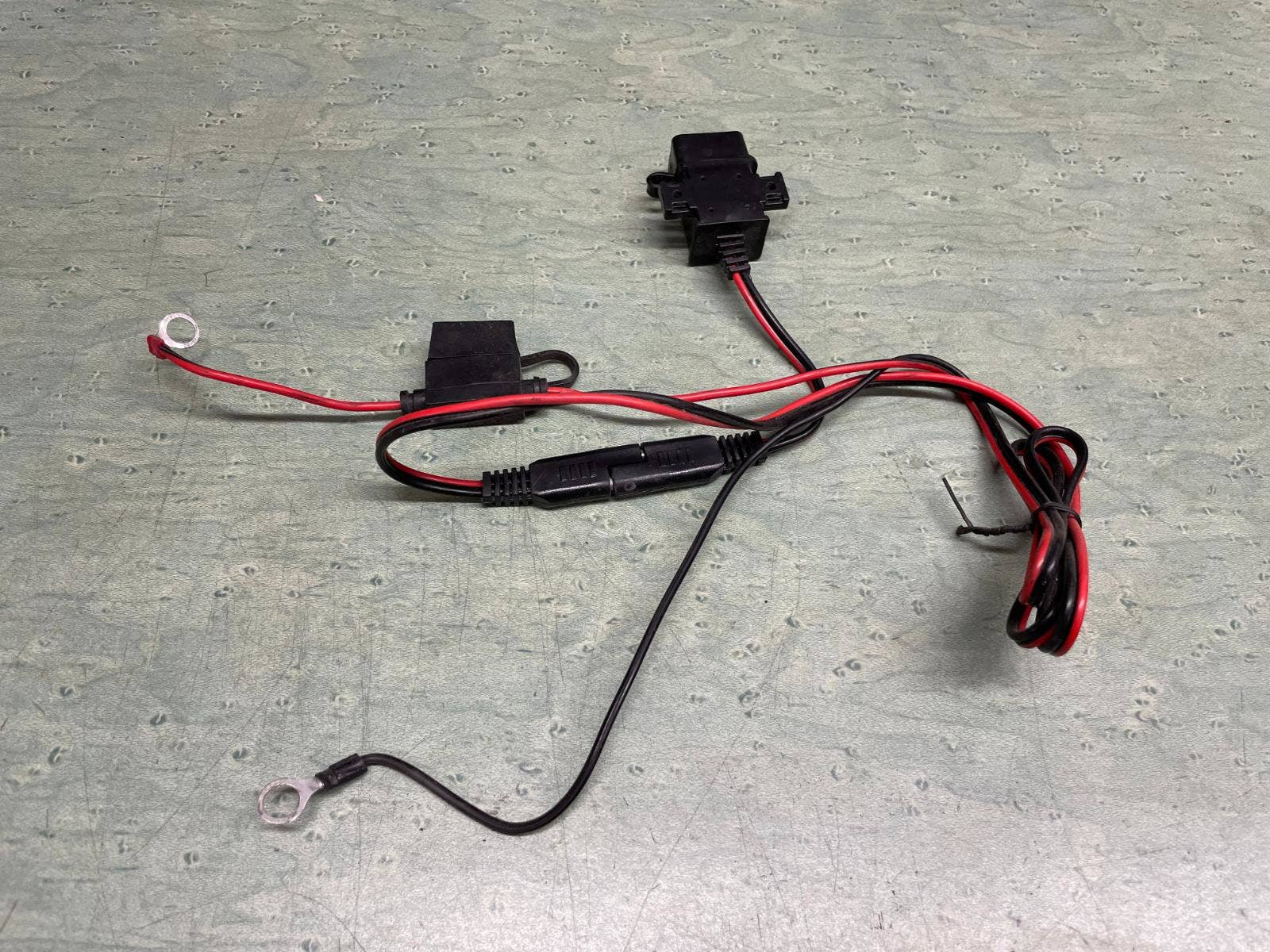

Elektrika > kabely > Kabel nabíječky USB a dobíjení baterie Motopower pro Honda CB 600 F Hornet, Litoměřice - TipMoto.com - motodíly

Elektrika > kabely > Kabel nabíječky USB a dobíjení baterie Motopower pro Honda CB 600 F Hornet, Litoměřice - TipMoto.com - motodíly

Elektrika > kabely > Kabel nabíječky USB a dobíjení baterie Motopower pro Honda CB 600 F Hornet, Litoměřice - TipMoto.com - motodíly