O repasi celkově Základní údaje. Většinou zastaralé baterie Ni-Cd, nebo Ni-Mh nahrazujeme výkonnějšími, lehčími a menšími Li-ion. Ovšem trochu něco za něco. Aby Lionky mohly dobře pracovat, jsou řízeny elektronickou destičkou, která

Automatická nabíječka AVACOM 6V/12V 4,5A pro olověné AGM/GEL akumulátory (1,2 - 120Ah) - NAPB-A045-612 | AVACOM - baterie & akumulátory

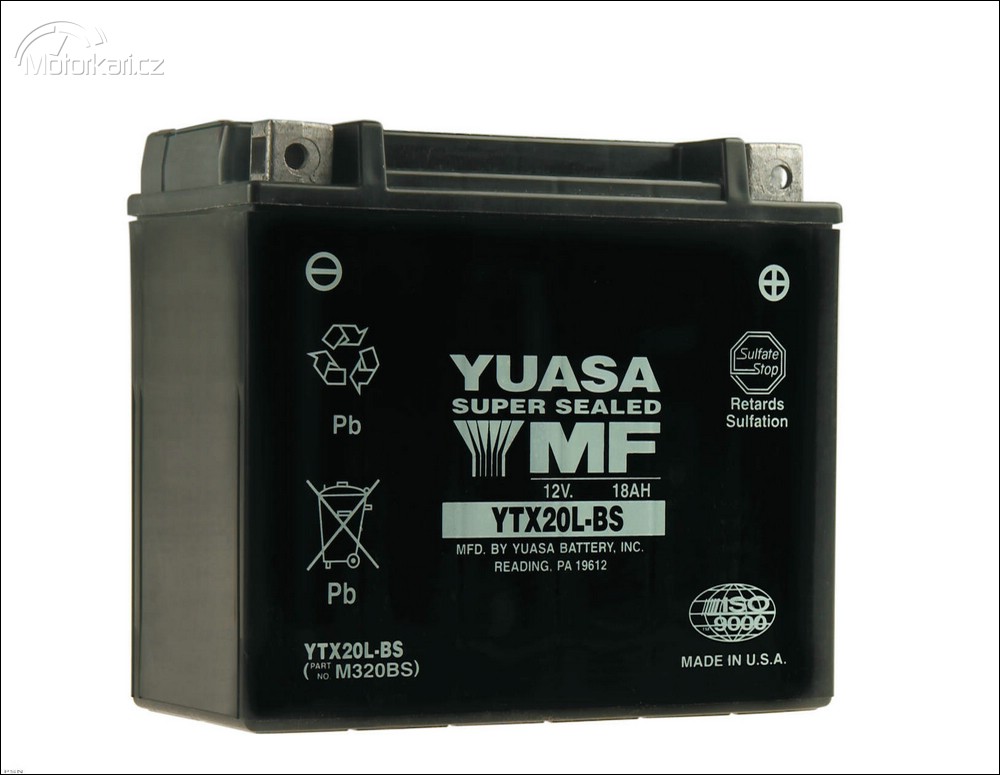

Nabíječka akumulátorů Geti CC01A 6/12V-1A baterií olověných, gelových, hermeticky uzavřených, WET (kyselinové), MF (bezúdržbové),