AVH 270 nabíjecí redukce pro Sony NP-55/66/77 6V, PB-220 4.8V Ni-MH/Ni-Cd video baterie - AVH270 | AVACOM - baterie & akumulátory

YUNIQUE GREEN-CLEAN 1 kus dobíjecí baterie 4.8V Ni-MH 2400 mAh pro dálkové ovládání auta + USB nabíjecí kabel | MALL.CZ

YUNIQUE GREEN-CLEAN 1 kus dobíjecí baterie 4.8V Ni-MH 2400 mAh pro dálkové ovládání auta + USB nabíjecí kabel | MALL.CZ

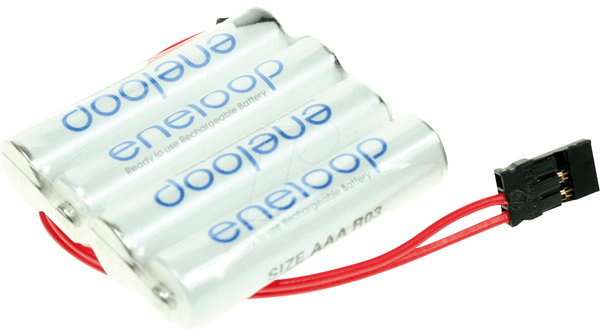

ENELOOP4 800-2 | Panasonic Industry Europe Nabíjecí bateriový modul, NiMH, 4.8V, 800mAh | Distrelec Česká republika

USB nabíječka 4.8V 250mA SM - RC modely dronů, vrtulníků, aut, letadel, tanků a hraček | RCobchod.cz