3 Things to Know Before Investing in Single-Family Homes

Recently, real estate and business journal reports found the highest number of total home purchases by investors in 2021 were in metropolitan markets. The Great Recession in 2008 with the real estate market collapse showed a similar pattern of buyers, bidding wars, and escalating prices in such regions. Since then, we have seen a shift in investment patterns with tremendous, accelerated growth potential across the country in new markets- one of them being single-family homes. With this in mind, we anticipate more interest in 2022 and encourage sophisticated investors to learn how to take advantage of great market opportunities as they come along.

I have bought, renovated, and flipped many houses and the difference between a successful deal and a financial loss is in due diligence. Here are some important considerations to factor before getting into single-family residential investing.

Hope is not a Strategy

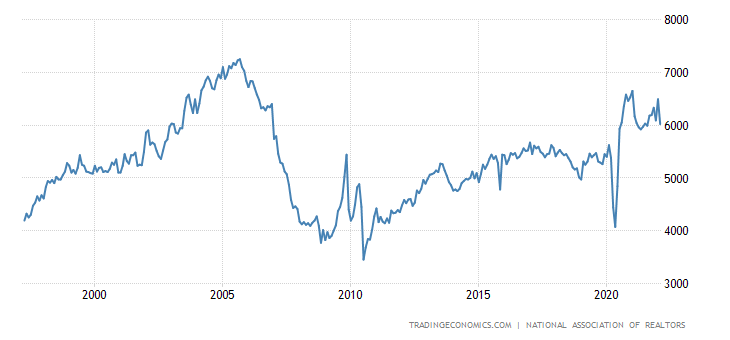

The purchase price is THE most important factor. Usually, people want to purchase property in the hopes that the market will keep going up and at some point, they will be able to sell at a higher value than what they purchased to make a profit. That may just be the case, and all is well as long as the market is rising. Until it doesn’t. In 2008, many people got stuck with no chair when the music stopped in the housing crisis. With that, here’s a tip: markets do go down as you can see in the chart below. This time period is critical as a successful deal will be one that you purchase below existing market prices. Informed by this, I made sure to exclusively buy deals that were 20%-30% below market. This way when the market falls, you still have equity in the property.

Renovations

The next most important aspect of purchasing a single-family house is the renovations. The renovation costs and timeline will vary for every project and depend on whether you are flipping the house for renting. For example, rentals don’t need particular home features like new chandeliers or amenities. So how do you determine how much to spend? For rentals, keep it basic.

No custom paint, cabinetry, or fixtures. Everything should be easily replaceable because chances are there is a risk that repairs may have to be made over the course of a short or long period of time. For flips, the best way I found to determine what the upgrades and finishes are by looking at pictures of other houses that were successfully sold in the area. Simply put, you are operating in a competitive market, and you can’t expect to get similar prices with outdated features.

Exit Price

Another item that will have to be determined during the due diligence process is how much can you sell the property today. Even if you plan on holding it forever, you should know how much equity you are walking into. The simplest way is to look at the comps of houses that were sold in the area and days on market (DOM). If the house is sitting on the market for 6 months, it’s an indicator that it’s too expensive and is not marketed to sell as it could also have other undesirable elements at play.

Conclusion

As an investor, you should know to walk away from any deals that don’t make financial sense. Keep your FOMO (fear of missing out) in check because the market will shift as we’ve seen in the chart above- certainly worth having patience and making the right call when the opportunity presents itself. So be sure to keep an eye on the market and soon you’ll find the deals will start coming. Another helpful tip here is to develop and/or strengthen your relationships with realtors, wholesalers, and hard money lenders that can help you make a cash offer on a property and close the deal quicker. Ultimately, it doesn’t matter what the state of the market is, your objective as a buyer is to pay 20%-30% below the market rate. And always remember, patience and due diligence are key.

Junaid Noor, CEO

Albany Park Capital

Leave a Reply