What is Real Estate Tokenization?

Tokenization is a topic that is quickly approaching relevancy in real estate as crypto settles into a niche in the real estate industry. Currently, this niche is still in its infancy and is rapidly growing abroad while keeping domestic firms and investors eager for its arrival and regulation in the United States. This two-part series will explain what tokenization is, how it works, and why it positively impacts the industry for all investors.

What is Tokenization?

Essentially, tokenization of real estate functions and acts similarly to a REIT (Real Estate Investment Trust) in the sense that you are buying real estate securities in a single asset or a portfolio of assets. The distinct advantage that tokenization has over a traditional REIT is its liquidity. Traditional REITs are regarded as being illiquid investments. Tokenization can further lower the barrier of entry for investors, broadening the investor base by driving down the price through decreasing costs and increasing the liquidity of the assets. This will make these tokens far more convenient to invest in, more accessible to investors than a traditional REIT, and more efficient for firms and investors.

Now that you know the difference between tokenization and a conventional REIT, you may wonder what separates the “tokens” from traditional cryptocurrencies? While both uses the blockchain technology, they use it differently. Tokenized real estate uses the blockchain as an “e-contract” between the investor and firm and represents defined equity or entitlement to dividends. In contrast, crypto uses blockchain to verify and secure the transaction.

How does it work?

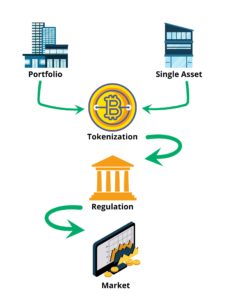

First, an entity or a “Special Purpose Vehicle” must be formed. Then tokenization uses a blockchain that a range of companies can provide to create the token which then acts as an electronic agreement between the asset holder and investors. This e-contract can entitle the token owners to rights such as dividends, equity, and any other rights that the e-contract expresses. From this point, comes the distribution/issuance of the coins. It is very similar to an Initial Public Offering (IPO) in the stock market. In fact, this process is referred to as a Security Token Offering (STO). When the tokens reach this state and are finally used in a transaction, the blockchain then carries out the transfer of the contract with no human interaction and completely eliminates the administrative costs that typically accompany the purchases of these assets. The image below provides an overview of the tokenization process.

Conclusion

Tokenization is undoubtedly a trend that investors should keep an eye on as we watch this unfold before us. In addition, the newness of this market shift will give investors the chance to get in on the ground level of this industry-disrupting technology.

Leave a Reply